One of the least talked about aspects of global warming is the effect it will have on insurance policies for coastal communities. I live in one such coastal community. It seems that the risk of climate caused disasters is having a detrimental effect on the local insurance policies. Simply put, the insurance companies don’t think the risk is worth it.

One of the least talked about aspects of global warming is the effect it will have on insurance policies for coastal communities. I live in one such coastal community. It seems that the risk of climate caused disasters is having a detrimental effect on the local insurance policies. Simply put, the insurance companies don’t think the risk is worth it.

Try to see it from their point of view, you own a giant multi-million dollar beach front mansion, every couple of years a giant hurricane could come and demolish this behemoth. Do you as a insurance provider want to pay this person millions of dollars every ten years to rebuild their home in the same spot? Of course you don’t.

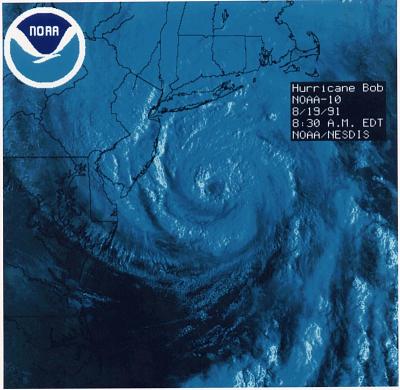

With the specter of global warming rearing its ugly head the risk that that multi-million dollar home will be washed away becomes even more real. Insurance companies are starting to pull policies.

Obviously the home owner is not going to see it this way. They might not also make the connection that the Hummer they have in the drive way is part of the reason they are losing their home owners insurance.

From here.

home insurance companies are pulling policies, saying places such as Cape Cod are too high of a risk.

Built in 1840, the Aschettinos’ house in Eastham, Mass., has withstood many storms.

Michael Aschettino and his wife bought the property eight years ago and have never filed an insurance claim. One day, they got a letter from their insurer, the Hingham Mutual Group, informing them their policy was not being renewed.

“I was furious in regards to money that we had paid in here for the eight years that we’ve been here. Take the money and run,” homeowner Paula Aschettino said.

“Insurance companies were designed to protect the people against financial loss. Instead, they’re protecting themselves against financial loss, and the poor customer is picking up the loss himself,” Michael Aschettino said.

It is a similar story up and down the East Coast, with homeowner insurance rates skyrocketing 20 to 100 percent and with insurance companies abruptly canceling policies where homeowners never put in a claim.

Hingham Mutual said it sent nonrenewal letters to 9,000 Cape Cod homeowners considered to have high-risk properties. The company claims premiums on its own insurance, called reinsurance, have gone up 40 to 70 percent.

A spokesman said, “It’s very discouraging to pull out of that area. We’re only doing it because of the economics.”

We must not forget that these events do not always effect just the super rich. Poor people that live in coastal areas are also hard hit by these changes in insurance policies. People with less economic power also have less disposable income to handle the burden of not having insurance. They also are less able to move to a place with less harsh climate.

First, there are a few insurance companies who don’t “take the money and run” but they are VERY few. I live in Florida and have been watching this go on for years. The premise of how insurance *should* work and how insurance *does* work are two different things.

Second, if the stupid people didn’t insist on having waterfront property the insurance wouldn’t cost so much. The should be no permanant strutures (of importance) withing two miles of any shoreline – make for a marvelous park and cut down on pollution too. When the water rises from global warming fewer people would be affected. There would be fewer people to complain about offshore wind farms as well.

I’m not convinced state mandated insurance has worked out all that well. I think we should try without it for a few decades. See what those insurance companies think about that.

Oh yeah, I forgot. I thought we gave everything northeast of Pennsylvania to Canada as punishment for being, well, Canadian :)